KBzine: the original kitchen and bathroom industry e-news - since 2002

28th January 2021

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

Consolidation continues in the UK builders & plumbers merchants market

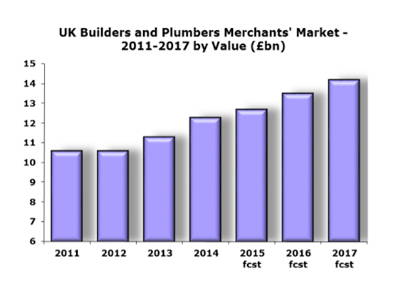

The builders and plumbers merchants market saw strong recovery during 2013 and 2014, following a period of relatively poor market performance, reaching growth of 6% in 2013 and 9% in 2014.

The builders and plumbers merchants market saw strong recovery during 2013 and 2014, following a period of relatively poor market performance, reaching growth of 6% in 2013 and 9% in 2014.

This, says a new report, was due to the housebuilding sector in particular starting to recover, with other key sectors that stimulated demand for merchants' products including offices, infrastructure, industrial and education. Indications are that growth was slightly lower in 2015 at 4%, though the overall trend remains positive.

In 2014/15 it is estimated that merchant sales accounted for around 9% of total construction output, indicating that the merchants remain an important distribution channel in the overall construction market. The merchants offer an extensive range of products, with the traditional building products still dominating the merchants' product mix. Plumbing & drainage account for around 17% and heating & ventilation for around 15%, with other sectors commanding smaller shares.

The market is dominated by a leading group of five organisations that account for an estimated share of over 75% of the market. Since the economic downturn, the merchant market has undergone some significant structural changes, with the market consolidating as some of the larger companies have acquired relatively smaller, but established merchants. Difficult trading conditions experienced in recent years have led to increased competition from other channels, particularly Internet-based operations.

"The impact of the construction downturn was initially more significant for the merchants, with DIY outlets benefiting from consumers switching major home improvement projects in favour of lighter DIY tasks," comments Keith Taylor, director of AMA Research. "However, since 2013 the merchants have performed better than the DIY multiples, benefiting from the significant growth seen in housebuilding and some non-domestic new work in particular and also the growth in house prices driving the residential refurbishment sector."

The market is price sensitive, something which is driven by competition, energy & fuel costs, volatile prices of raw materials and product availability. Whilst price increases boost market size, they contribute to some margin erosion in merchant business, principally in respect of commodity and 'known value' items.

Buying groups continue to play an important role in the merchants' market, particularly for regional and local merchants, and the sector has undergone some changes recently with mergers of leading organisations.

Future prospects for the merchant market remain relatively optimistic with increased confidence in the continued recovery of the UK economy and that it will be sustained. Construction activity levels are increasing, although the rate of growth is thought to have slowed slightly in 2015 and the rate of recovery remains vulnerable. However, forecasts are broadly positive, with growth rates of between 3-6% per annum forecast until 2019.

Drivers in the residential sector include the traditional UK under-investment in housing stock in terms of new build requirements, also the age of the current dwellings stimulates expenditure of RMI activity; the current confidence in the new housebuilding sector in terms of starts, forward reservations, completions and average prices. Returning confidence and investment levels in the private commercial sector are likely to be one of the key drivers for growth in non-residential output into the medium-term, with good growth forecast in the office sector in particular. The market will also be influenced by the cost of fuel and energy as well as the volatility of the exchange rate of Sterling against both the US Dollar and the Euro, the rising cost of raw materials and product shortages as well as potential skills shortages.

The 'Builders and Plumbers Merchants Market Report - UK 2015-2019 Analysis' report, summarised here, is published by AMA Research, a leading provider of market research and consultancy services with over 25 years' experience in the construction and home improvement markets. The report is available now and can be ordered via:

T: 01242 235724

W: www.amaresearch.co.uk

15th January 2016