KBzine: the original kitchen and bathroom industry e-news - since 2002

28th January 2021

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

UK inclusive bathroom and kitchen products market sees 4% growth

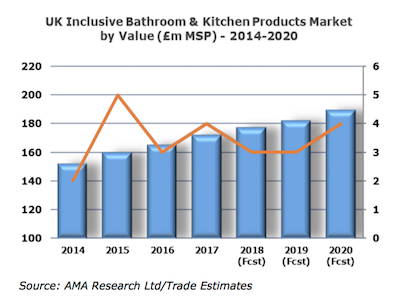

The UK inclusive bathroom & kitchen products market is estimated to have increased by around 4% in 2017, when compared to the market size in 2016 - despite the uncertain general economic situation and a slowing construction sector.

The UK inclusive bathroom & kitchen products market is estimated to have increased by around 4% in 2017, when compared to the market size in 2016 - despite the uncertain general economic situation and a slowing construction sector.

Growth is thought to have been stimulated by a higher level of housing completions, which supported demand for inclusive bathroom & kitchen products at this time. The outlook for the market in 2018 looks moderately positive with good growth anticipated into the medium-longer term.

Following a decline in 2012, which was experienced across the general construction industry, the UK inclusive bathroom & kitchen market started to recover from 2013, reports AMA Research. The pace of growth then accelerated in 2014 -2015, with a steady recovery in the housing market and an improvement in both business and consumer confidence levels supporting RMI activity. 2016 also experienced growth, although at a lesser pace than previously.

The largest sector within the inclusive kitchen & bathroom products market is showering facilities, which continues to dominate sales, partly due to many baths now being replaced by easy access shower enclosures and wetroom areas. Other significant sectors within this market include bathroom accessories, inclusive kitchen facilities, toilet facilities and bathroom taps & mixers, while baths account for a smaller share.

Inclusive kitchens are predominantly used by wheelchair users and tend to be custom-built solutions designed specifically to a homeowner's requirements. Products include rise & fall units, lever-operated or remote sensor operated taps and mixers, shallow depth sinks, large/deep storage drawers, linear induction hobs and 'slide and hide' ovens.

A key factor in the growth in demand for inclusive bathroom and kitchen products is the aging population. In addition, the number of multi-generation households in the UK is also increasing. The shortage of suitable affordable housing for elderly relatives in need of care is driving more families to house three generations in one property, and these types of households have increased by over 42% in the last decade.

Similarly, the trend towards care in the community has also contributed to the increasing numbers of elderly and disabled people continuing to live at home.

The inclusive bathroom & kitchen market has been positively impacted by new product development and the trend towards product solutions that are suitable for all users. As such, inclusive bathroom & kitchen products have become much more aesthetically pleasing. Consumers are increasingly demanding attractive designs that will 'future-proof' and add value to their property; and are also suitable for all family members to use.

A significant proportion of the inclusive bathroom & kitchen products market represents direct sales from the specialist manufacturer or supplier to the end-user, which is common practice with specialised products. Other channels include merchants and distributors plus home improvement multiples, many who offer own branded goods. In addition, the level of inclusive bathroom and kitchen products sold via online retailers has seen significant growth in recent years.

"With an increasing number of elderly and disabled people in the UK, and the continued trend towards multi-generational households, the growing demand for inclusive bathroom and kitchen products looks set to continue. By 2022, the market value is forecast to have increased by 16% compared to the market size in 2017," notes Hayley Thornley, market research manager at AMA Research.

There will continue to be a very large demand for disability adaptations in existing homes. This is partly driven by Government funding for Disabled Facilities Grant programme provision, which rose to £394 million in the 2016-17 funding period, and is projected to increase to over £500 million by 2019-20. In terms of new housing, the 2015 revisions to Part M should continue to support demand for inclusive bathroom and kitchen products specified in this sector.

Technological improvements such as rimless WC pans with low flush technology, digital shower controls, shower toilets, automatic rise and fall kitchen units, and TMV3 approved thermostatically controlled mixer taps will also add value to this market sector. As aesthetics increase in importance, there will be an increased focus on quality and design, which should support a shift towards higher value products.

The 'Inclusive Bathroom & Kitchen Products Market Report - UK 2018-2022' report, is published by AMA Research, a leading provider of market research and consultancy services with over 25 years' experience within the construction and home improvement markets.

The report is available now and can be ordered via:

T: 01242 235724

W: www.amaresearch.co.uk

1st June 2018