KBzine: the original kitchen and bathroom industry e-news - since 2002

22nd December 2020

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

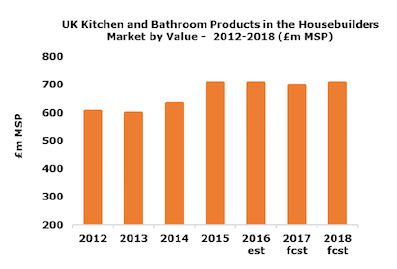

New housebuilding in 2015 sees 12% increase in kitchen and bathroom products market

New housebuilding is an important end use sector for kitchen and bathroom products, and in 2015 it was estimated to account for approximately 13% of the overall UK kitchen and bathroom products market. The market for kitchen and bathroom products in newbuild housing increased by an estimated 12% in 2015 to reach a value in excess of £700m, reflecting the continued steady improvement in the UK economy, consumer confidence levels and significant growth in the housebuilding market.

New housebuilding is an important end use sector for kitchen and bathroom products, and in 2015 it was estimated to account for approximately 13% of the overall UK kitchen and bathroom products market. The market for kitchen and bathroom products in newbuild housing increased by an estimated 12% in 2015 to reach a value in excess of £700m, reflecting the continued steady improvement in the UK economy, consumer confidence levels and significant growth in the housebuilding market.

Kitchen appliances accounted for the largest sector of kitchen and bathroom products in the housebuilders market with 40% share by value. Other key product sectors reviewed in AMA Research's report include kitchen furniture, worktops, sinks and tapware, bathroom products and shower products.

Following a static period between 2011 and 2013, market conditions have steadily improved in 2014 and 2015 with housebuilding levels showing good growth, supporting new build kitchen sales via contractors, developers, distributors and merchants.

The shift towards three and four bedroom homes has supported larger new build kitchens and additional utility room installations in the new build sector.

Most housebuilders offer homebuyers the option to customise their new kitchen and use predefined ranges of products such as worktops, splashbacks, furniture, tiles, lighting and appliances.

Key trends in new build kitchens include; a focus on layout and design, growing popularity of kitchen-diners with a seating area, growing demand for 'hotel-style' quality interiors, increasing focus on durability, particularly in the social housing sector, increasing usage of well-known reputable brands of kitchen appliances in order to attract buyers and an increasing choice of worktop materials and designs, with built-in or integrated appliances installed in the majority of new build homes.

Kitchen taps have become more advanced with added value options including pull-out hoses for food preparation, integral water filters and the hot water boiling tap.

Trends worth noting in the new build bathroom sector include; a continued trend towards two or more bathrooms / ensuites, increasing investment in quality fixtures and fittings offering longevity and luxury, minimalist designs, 'future proofing' of bathrooms so they can be easily adapted to changing needs driven by an ageing UK population, increasing popularity of wetroom areas, and higher usage of digital technology in the premium sector in applications such as digital shower controls, spa baths, sensor operated mixer taps etc.

Despite the general trend towards showering, a bath continues to be an essential feature in the main bathroom in the vast majority of new build homes.

With a growing proportion of flats and apartments expected in the longer term and the small size of the average UK bathroom and kitchen, there will be a continuing demand for space-saving solutions, such as wall-hung sanitaryware, clever kitchen storage, slim-line appliances and compact bathroom furniture.

Housebuilders are continuing to focus on family homes, which should drive sales of larger, higher value kitchens.

Increased choice is likely to become more important as housebuilders compete to attract homebuyers, with branded 'connected' appliances, solid surface or stone worktops, digital showers, freestanding baths, wetroom areas etc. being increasingly offered.

"The new housing sector continued to recover until mid-2016, underpinned by mortgage assistance schemes such as Help to Buy, a more buoyant economy and undersupply for a number of years," notes Keith Taylor, director of AMA Research. "However, the referendum decision to leave the EU has resulted in some economic uncertainty and housebuilders are likely to remain cautious. Consequently, this may result in a lower level of housing starts in 2017, which will affect volume sales of bathroom and kitchen products into the new housing sector."

Although Brexit may have a negative effect on the construction industry and a decline is likely in some sectors including housing - particularly in volume terms - underlying demand and the possibility of higher costs for imported raw materials and products, may support value growth in the housebuilding as well as the kitchen and bathroom sectors.

The value of kitchen and bathroom products in the housebuilding market is forecast to grow by around 4% between 2016-2020.

The 'Kitchen and Bathroom Products in the Housebuilding Market Report - UK 2016-2020 Analysis' report is available now and can be ordered via:

T: 01242 235724

E: [email protected]

W: www.amaresearch.co.uk

23rd September 2016