KBzine: the original kitchen and bathroom industry e-news - since 2002

22nd December 2020

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

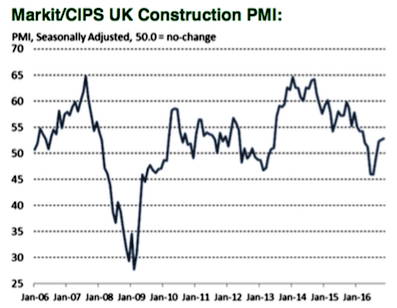

"Strong demand for residential projects" reports latest Markit/CIPS UK Construction PMI

The latest Markit/CIPS UK Construction Purchasing Managers' Index, published today, reports improved order books, alongside resilient client confidence and strong demand for residential projects. Housebuilding activity remained the best performing category of construction output during November, despite the pace of expansion slipping to a three-month low.

The latest Markit/CIPS UK Construction Purchasing Managers' Index, published today, reports improved order books, alongside resilient client confidence and strong demand for residential projects. Housebuilding activity remained the best performing category of construction output during November, despite the pace of expansion slipping to a three-month low.

November data indicated that the UK construction sector continued to rebound from the weak patch recorded on average during the third quarter of 2016. Business activity and incoming new work increased at the strongest pace since March, although both rates of expansion remained much softer than the peaks achieved at the start of 2014. Greater workloads underpinned a further solid rise in employment levels and input buying among construction firms.

The seasonally adjusted PMI picked up slightly to 52.8 in November, from 52.6 in October, thereby signalling an expansion of total business activity for the third month running.

However, average cost burdens rose sharply, with the rate of inflation the steepest since April 2011 and there were again reports that heightened economic uncertainty was a key factor weighing on output growth across the construction sector.

Construction firms meanwhile reported a marginal rebound in commercial activity, which ended a five-month period of decline. Civil engineering work remained the weakest area of activity.

Increased volumes of construction output were underpinned by a solid upturn in new work during November. The latest rise in incoming new business was the strongest since March and contrasted with a sustained decline in sales through the summer. Some construction firms noted that their workloads had been boosted by a resumption of projects that were delayed after the Brexit vote. However, there were also reports that the stronger inflation backdrop had led to intense competitive pressures and squeezed margins.

UK construction companies reported a steep and accelerated rise in their cost burdens in November, with the rate of inflation the fastest for just over 5.5 years. This was overwhelmingly linked to supplier price hikes in response to exchange rate depreciation.

Purchasing activity meanwhile increased at the fastest pace since the start of 2016. Stronger demand for inputs and low stocks among vendors resulted in the sharpest deterioration in supplier performance since June.

"UK construction companies experienced a steady recovery in business activity during November, which continues the rebound from the downturn seen over the third quarter of 2016," says Tim Moore, senior economist at IHS Markit and author of the Markit/CIPS Construction PMI, of the findings.

"The brighter picture reflected another solid contribution from residential building and renewed growth in commercial work, which some companies linked to a resumption of projects that had been delayed after the Brexit vote.

"November's survey data revealed the strongest rise in overall new business volumes since March. However, lingering economic uncertainty and subdued investor sentiment meant that optimism towards the year-ahead outlook remained close to its lowest since early-2013.

"Input cost inflation accelerated to its fastest for five-and-a-half years, driven by sharply rising imported raw material prices. A number of firms cited uncertainty related to supplier price hikes as an emerging threat to the construction sector, with survey respondents commenting on difficulties forecasting project costs against a backdrop of rapidly changing inflationary pressures."

Job creation was maintained across the construction sector in November, while the latest survey also highlighted the fastest rise in sub-contractor usage so far in 2016. A number of firms linked additional staff recruitment to robust confidence regarding the near-term demand outlook. That said, business confidence was still softer than seen during the first half of the year, with construction companies generally noting that Brexit-related uncertainty had the potential to weigh on business activity during 2017.

David Noble, group chief executive officer at the Chartered Institute of Procurement & Supply, says:

"The sector was on a firmer footing this month, as a slight uptick in overall activity and the strongest level of new business growth since March, resulted in more stability after a summer of uncertainty at the time of the EU vote.

"Purchasing activity grew at its fastest pace since the beginning of the year as stronger workflows and tenders materialising into actual projects prompted increased levels of stock building. This resulted in a sluggish response from suppliers, with the fastest lengthening of delivery times since June, as pressure on capacity and low stocks impacted on demand.

"Once again residential activity led the way, though at softer rates than those seen in October and at a more diminished rate than the survey's long-range norm. Though this positive growth will provide some relief for the economy, continuing cost pressures will be a worry for the sector in the coming months. The impact of the weaker pound was widely felt in November, with cost inflation the strongest since early-2011. Higher prices were reported for a number of materials including bricks, blocks and slate, as businesses struggled with managing costs. Yet, in spite of this grip on precious margins, headcounts were increased and demand for sub- contractors was also sustained.

"Reports of lingering uncertainty around the progress of Brexit negotiations had business optimism divided, where only 45% of respondents expected a rise in activity next year - one of the lowest since the middle of 2013. And, as commentators warn about more inflationary impacts next year, the sector will be concerned that decisions from policymakers must ensure these effects are minimalised so that growth is maintained."

2nd December 2016