KBzine: the original kitchen and bathroom industry e-news - since 2002

22nd December 2020

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

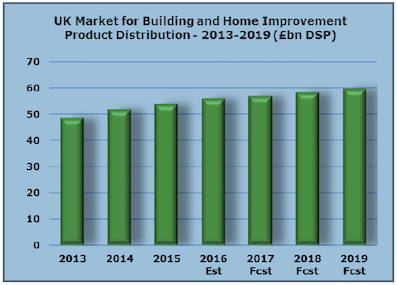

Mixed performance in UK building and home improvement product distribution market

The UK building and home improvement products distribution market is a large, mature market and as such tends to experience modest year on year change. In both 2015 and 2016, the market has performed well displaying growth rates of 4% per annum according to a new report by AMA Research.

The UK building and home improvement products distribution market is a large, mature market and as such tends to experience modest year on year change. In both 2015 and 2016, the market has performed well displaying growth rates of 4% per annum according to a new report by AMA Research.

This growth, say the report's writers, was driven by value increases and a modest improvement in confidence, though while house building showed modest improvement, public sector funding cuts continued to impact large scale construction projects.

In general, market growth has been healthy since 2014, when the market value increased by 7%. This was due to a strong housing market with new housebuilding up 31% in terms of completions and some product sectors showing high levels of growth, such as solar energy technology which was boosted by an announcement that Feed In Tariffs were declining significantly, prompting sales/commitments before this occurred.

The market is relatively evenly split between heavyside and lightside products. Leading product sectors include timber & glazing, bricks, blocks, building envelope & concrete (BBBEC) and heating & plumbing.

The distribution market is complex, with a small number of large organisations competing with many regional and local organisations. The leading group of players now consists of four builders and plumbers merchants and three home improvement multiples.

Other suppliers who have become important within the market include Screwfix and Toolstation. Internet distribution has grown in recent years, especially in those channels where the products are more disposed to consumer preference and choice, are more physically compact and can more easily be delivered, such as plumbing and certain garden products. Nevertheless pure Internet distributors retain a relatively modest share in most sectors.

The changing socio-demographic structures are stimulating a shift away from DIY, with the younger generation unable to leave home or renting until they are in their thirties, resulting in less motivation to undertake DIY, and at the other end of the scale, the older generation use tradesmen to do their DIY.

In addition, the growth of flats and apartments as well as smaller houses, will stimulate a shift away from DIY as there is simply less room to make improvements and changes.

The future prospects of the building and home improvement products distribution market are extremely difficult to forecast as the future development of the market is highly dependent on the levels of business investment and confidence in the wake of the EU referendum vote and the nature of negotiations with the EU over the next two years.

Over the next two years the construction industry is expected to show very modest growth of 1-2% overall reflecting a mix of performances across the sectors, with the infrastructure sector and the health sector expected to perform reasonably well, while offices and retail perform less well.

AMA Research forecasts value growth of 2-3% per annum for the building and home improvement products distribution market, reflecting expected price increases in a number of product sectors and improving confidence in the medium term.

"While housebuilding levels have improved, it seems likely that this growth will not continue over the next two to three years as the market adjusts to the EU vote and exit process, and is therefore likely to remain more stable," says Keith Taylor, director of AMA Research.

"Market growth will be impacted by the weakening of the pound following the EU referendum, making imports more expensive, a particular issue in areas such as electrical accessories and baths and sanitaryware, where imports take a significant share of the market."

The 'Building and Home Improvement Products Distribution Market Report - UK 2017-2021 Analysis' is available now and can be ordered via:

Tel: +44 (0)1242 235724

E-mail: [email protected]

Website: www.amaresearch.co.uk

17th February 2017