KBzine: the original kitchen and bathroom industry e-news - since 2002

28th January 2021

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

New report reveals acquisition targets

Traditionally, a typical acquisition strategy revolves around acquirers looking for a cut-price deal by preying on struggling and vulnerable businesses.

Traditionally, a typical acquisition strategy revolves around acquirers looking for a cut-price deal by preying on struggling and vulnerable businesses.

The UK bathroom retailers industry is no different. However, new research into the financial health of the UK bathroom retailers market by business analysts Plimsoll Publishing suggests this needs to change over the next 18 months.

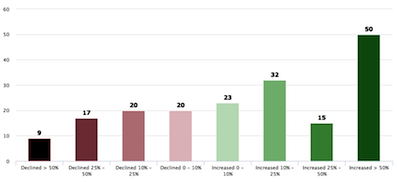

Plimsoll's latest report into the largest 228 bathroom retailers operating in the UK has identified 46 'high-class' acquisition targets which would enable prospective new owners to move into growing and highly profitable areas of the market.

Despite the fact that these categories of companies are likely to cost a premium, these 46 'high-class' targets offer potential investors a real opportunity to strengthen their position in the market and allow the company to continue on its upward trajectory.

Further findings include:

* 14 of these companies are highly profitable - these businesses offer the chance to move into a profitable area of the market and by being privately owned could make negotiations less arduous

* Three companies are growing at over 10% - these companies are among some of the most successful in the market

"It is a long-standing debate, when considering an acquisition, do you buy cheap or high value?" asks Plimsoll's senior analyst, David Pattison.

"In reality, most people's idea of an acquisition is to wait until the business has declined so far... meaning the only option is for a new owner to come in and save the business - essentially spending peanuts.

"However, we feel this approach needs to change. The acquisition strategy should be based on the direction of the current market. By acquiring a successful business, it gives both the company and the new owners a chance to add new investment and further cement their position in the market, whilst the current owners may feel they have taken the business as far as they can."

Plimsoll's latest study into the 228 major players in the industry also reveals:

* 100 companies have been rated as 'strong'

* 19 businesses have lost a third of their value

* 61 firms are making a loss

For over 30 years, the Plimsoll Analysis has been used by senior decision-makers to help monitor competitors, analyse key market trends and identify acquisition prospects.

The Analysis examines the largest 228 companies operating in the UK as well as the 46 high class acquisition targets.

For any other questions or enquiries:

T: +44 (0) 1642626419

E: [email protected]

W: www.plimsoll.uk

20th October 2017