KBzine: the original kitchen and bathroom industry e-news - since 2002

22nd December 2020

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

Moderate growth for UK shower market in 2017; market penetration now at c.90%

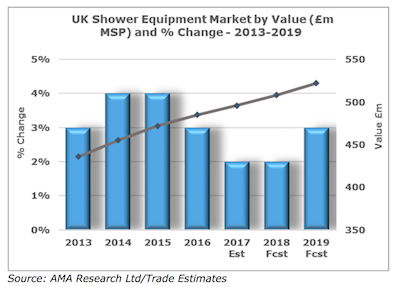

In 2017, the value of the shower equipment market is estimated to have seen a moderate increase of around 2%, according to a new report by AMA Research. This follows a similarly modest increase of 3% in 2016.

In 2017, the value of the shower equipment market is estimated to have seen a moderate increase of around 2%, according to a new report by AMA Research. This follows a similarly modest increase of 3% in 2016.

The level of penetration for showers has climbed significantly since the late 1990's to reach around 90% in 2016, with at least one shower installation in the majority of UK households. Continued steady growth of around 2-4% per year is currently forecast to 2021.

Following two years of good growth due to increasing levels of new house building boosting demand and relatively buoyant consumer confidence supporting RMI activity, the shower equipment market was more subdued in 2016 and 2017, with 5% growth achieved over the two years.

Shower controls account for the greatest proportion of the shower equipment market with 46% share by value in 2016. Enclosures, screens and trays account for somewhat less than the shower controls sector, while the maturing shower market and higher level of shower usage, has led to some share growth in replacement products, such as shower accessories.

In recent years, product development and improvement in the shower equipment market has focused on quality and design with a trend towards higher value products and contemporary styles. Demand for digital showers have also shown good growth as the use of 'smart' technology in UK homes becomes more prevalent, with plumbing installers also increasingly familiar with digital showers and the installation benefits they can offer.

As the shower market matures there are greater levels of replacement purchases leading to product upgrade and added value opportunities. An increasing number of shower products are now designed specifically for retrofit purposes, such as electric showers with multiple cable/water entry points and mixer showers with standard pipe centres.

Demand for 'inclusive' showering solutions is growing, as increasing numbers of elderly and disabled people are now living at home, creating demand for accessible solutions that make the bathroom easier to use and more functional. For example, walk-in enclosures or wetroom areas, level access trays, thermostatic shower controls with easy-to-use controls, shower seats, grab rails etc.

With environmental issues increasingly in focus, water saving is also becoming an important consideration. With over one third of UK homes on a water meter, the demand for water efficient shower controls is increasing. The addition of the Water Label on shower packaging has also made consumer product comparison of the water use between similar products easier and more transparent.

"The market is expected to increase by around 13% between 2018-2021," notes Hayley Thornley, research manager at AMA Research. "New housebuilding volumes are set to continue increasing despite the uncertainty currently surrounding the UK's exit from the EU, and prospects remain positive in this sector, supporting demand for showers installed in new build homes.

"In the commercial sector demand for showering equipment is likely to emulate from private new build and RMI activity in the hotels sector, care homes and health & fitness clubs/gyms."

The shower equipment market will continue to fragment and the number of own-label products, often sold via the Internet, is likely to increase. Online retailers are becoming significantly more important as consumers increasingly use the internet to source the best deals, but manufacturers are also selling spare parts and accessories direct to the consumer online.

Competition from non-UK suppliers is also set to grow, and pricing pressures are likely to remain intense due to the high level of imported product and the growing number of competitive distribution channels such as the internet, home improvement multiples and other major retailers.

The 'Shower Market Report - UK 2017-2021 Analysis' is published by AMA Research, a leading provider of market research and consultancy services with over 25 years' experience within the construction and home improvement markets.

T: +44 (0)1242 235724

E: [email protected]

W: www.amaresearch.co.uk

12th January 2018