KBzine: the original kitchen and bathroom industry e-news - since 2002

22nd December 2020

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

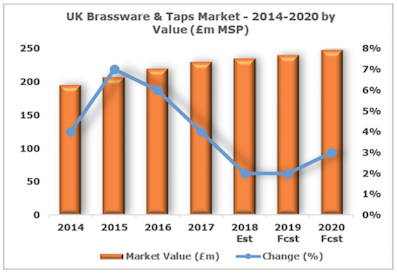

Brassware and taps market enjoys 4% value growth despite intense pricing pressures

The brassware and taps market in the UK, worth more than £200m, is estimated to have grown by 4% in 2017. Following a period of slow growth, the market improved between 2014 and 2016, driven by more favourable conditions in the new housebuilding sector and demand from the private commercial sector.

The brassware and taps market in the UK, worth more than £200m, is estimated to have grown by 4% in 2017. Following a period of slow growth, the market improved between 2014 and 2016, driven by more favourable conditions in the new housebuilding sector and demand from the private commercial sector.

A more modest performance is anticipated in 2018 and 2019, with consumer and business confidence expected to decline, impacting on demand for brassware and taps.

Basin brassware represents largest sector of the market with around 40% share, closely followed by kitchen taps with a similar share, while remaining 20% was accounted for by bath brassware.

The main distribution channel for brassware and taps continues to be builders and plumbers' merchants with the home improvement multiples also holding a substantial share. Other retail channels include kitchen and bathroom specialists, grocery and furniture multiples, direct supply and department stores. Online retailers are also becoming more important as consumers increasingly use the internet to source the best deals.

Along with durability, key factors such as quality and design will remain important in the UK brassware and taps market. Aesthetics will continue to exert a notable influence on consumer choice particularly with respect to total kitchen or bathroom co-ordination, but the issue of design has also gained importance in commercial applications such as hospitals and schools, with a shift away from the traditional institutionalised appearance towards more domestic orientated styling.

With an ageing UK population, there will continue to be a significant demand for inclusive brassware and taps that combine style with ease of use. For example, lever-controlled products, thermostatic mechanisms, and those designed with digital/electronic controls. Water saving will also continue to be an important consideration and growth is likely in product areas including aerated spray taps, low water content taps, and brassware with an in-built eco button etc.

In the future, there will be several key factors affecting the market prospects for the brassware and taps market in the UK. Housebuilding volumes have achieved good growth in recent years and this is expected to remain steady, albeit at a lower level compared to recent years, while RMI activity may be more constrained. However, refurbishment activity is expected to improve towards the end of the forecast period.

In the commercial sector, private work is typically a key driver of growth, but also relies upon business confidence, which is again expected to be stronger towards the end of the forecast period following the EU withdrawal. However, public sector spending cuts will continue to be an issue.

Exchange rates and the cost of imported goods have direct implications for brassware and taps produced or sourced from abroad. Any weakness of sterling makes imports into the UK more expensive, along with increasing transportation costs.

"Moderate to steady growth of 3% - 4% per annum is currently forecast from 2020 to 2022," says Hayley Thornley, market research manager at AMA Research. "The brassware and taps market will continue to fragment and the number of own-label products, is likely to increase.

"Pricing pressures are likely to remain intense due to the high level of imported product, weak value of sterling and the growing number of competitive distribution channels such as the Internet."

The 'Bathroom & Kitchen Brassware and Taps Market Report - UK 2018-2022' report

is available now and can be ordered via:

T: 01242 235724

W: www.amaresearch.co.uk

14th September 2018