KBzine: the original kitchen and bathroom industry e-news - since 2002

22nd December 2020

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

Water Saving Plumbing Products Market Report UK 2011-2015, now available

The UK water saving plumbing products market had shown excellent levels of growth until the economic downturn. Like other products in the building and construction industry, this market has been impacted by the global financial crisis.

The UK water saving plumbing products market had shown excellent levels of growth until the economic downturn. Like other products in the building and construction industry, this market has been impacted by the global financial crisis.

The market is estimated at £160 million at Manufacturers Selling Prices in 2010. 2011 estimates indicate an increase of 3%, reflecting some signs of stabilisation in the UK economy plus the positive impact of recent Government regulatory changes on this market sector.

Forecasts indicate that the UK water saving plumbing products market will return to growth in 2011-12. Following the changes to Part G of the Building Regulations in 2010, these products are in greater demand. In addition, the water consumption targets set by the Code for Sustainable Homes will increase to level 4 for public new housing in 2012, which will have a further positive influence. By 2015, the overall market value is forecast to be £219 million at MSP, which would represent an increase of around 33% compared to the estimated market size in 2011.

The core product sectors of the UK water saving plumbing products market are water efficient bathroom products (91%) and water recycling systems (9%).

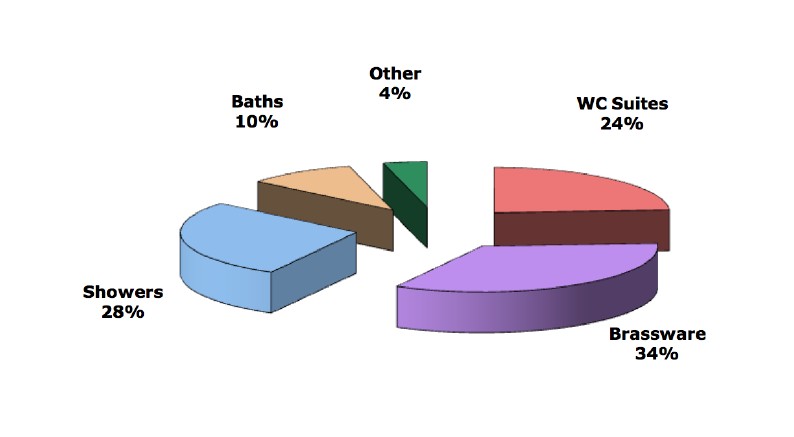

The water efficient bathroom product sector is estimated at £146 million at MSP in 2010. This sector comprises water efficient brassware (£50m), showers (£41m), WC suites (£35m), baths (£14m) and other products such as timed flow controls (£6m).

Within the water recycling systems sector, rainwater harvesting systems is estimated to be worth around £10m in 2010, with greywater recycling systems worth around £4m.

Water efficient bathroom products are distributed through a wide range of channels. The main distribution channel continues to be merchants with the DIY multiples also holding a substantial share. Other channels include bathroom specialists, and Internet e-tailers.

The vast majority of water recycling systems are distributed either through plumbing and drainage merchants or direct via water recycling specialists. There are also a growing number of Internet e-tailers operating in this market sector.

The future performance of the water saving plumbing products market is likely to be driven by Government legislative changes and growing concerns and attitudes towards water usage and its impact on the environment.

The Code for Sustainable Homes will continue to support demand for water saving products, particularly in public housing. Compliance requirements for water consumption in public residential properties will increase to level 4 in 2012 and level 6 from 2015. It may become necessary to install a water recycling system to meet these more stringent requirements.

Despite higher levels of rainfall in recent years, UK water supplies continue to decline, with many areas becoming under 'stress'. The Environment Agency predicts that by 2050, climate change and other factors will reduce the amount of water available by between 10 and 15%. Over the next 20 years, demand for water is set to increase still further. This will be driven by population growth coupled with higher levels of new house build, plus increasing per capita water consumption.

'Water Saving Plumbing Products Market Report - UK 2011 - 2015 Analysis' is available in hard copy or electronic format .

T: 01242 235724

E: at [email protected]

W: www.amaresearch.co.uk

2nd September 2011