KBzine: the original kitchen and bathroom industry e-news - since 2002

28th January 2021

We strongly recommend viewing KBzine full size in your web browser. Click our masthead above to visit our website version.

New AMA report provides a major review of the UK Shower Market

The latest AMA report on the state of the UK Shower Market concludes: "Forecasts indicate that the UK shower equipment market will stabilise in 2013 and return to modest growth from 2014, as consumer confidence and housebuilding levels gradually improve. By 2017, the overall market value is forecast to be £490 million at MSP, which would represent an increase of around 15% compared to the estimated market size in 2013, yet still be below the peak in 2008."

The latest AMA report on the state of the UK Shower Market concludes: "Forecasts indicate that the UK shower equipment market will stabilise in 2013 and return to modest growth from 2014, as consumer confidence and housebuilding levels gradually improve. By 2017, the overall market value is forecast to be £490 million at MSP, which would represent an increase of around 15% compared to the estimated market size in 2013, yet still be below the peak in 2008."

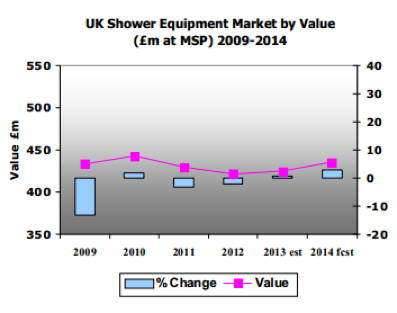

According to the report, the shower equipment market has an estimated value of around £422 million at Manufacturers Selling Prices (MSP) in 2012. This represents a decrease of around 2% when compared to the market size in 2011 and reflects the continued impact of the UK economic downturn on the housing and home improvement markets.

The UK shower equipment market has been volatile over the last five years. In common with other products in the building industry, the market has been impacted overall by the global financial crisis and resulting decline in the construction industry and the RMI sector.

Showering in the UK is approaching market saturation; around 88% of all UK households have some sort of shower installation. This level of penetration has climbed significantly since the late 1990's, corresponding with the widespread installation of showers in new build homes and the growing levels of installation in existing homes.

Shower controls account for the greatest proportion of the market with 44% of the overall shower equipment market. Enclosures, screens and trays account for only a fraction less than the shower controls sector at 43% share. With the economic downturn the share taken by shower accessories has grown to 13%.

Shower products for the domestic and commercial sectors are distributed through a wide range of channels. The main distribution channel continues to be builders and plumbers merchants with the DIY multiples also holding a substantial share. Other retail channels include bathroom specialists, grocery multiples, mail order retailers and department stores.

Online e-tailers are also becoming more important as consumers increasingly use the internet to source the best deals. Manufacturers are also selling spare parts, accessories etc. direct to the consumer online, via transactional websites.

The electric shower sector is expected to continue to perform relatively well in the short term with the greater demand for replacement products in particular. The mixer shower sector is expected to return to growth in the longer term, as the UK economy recovers and the housebuilding market picks up.

The shower equipment market will continue to fragment and the number of own-label products, often sold via the internet, is likely to increase. Competition from non-UK suppliers is also likely to grow as they increasingly develop their own concepts and designs rather than providing (cheaper) copies of existing solutions. Pricing pressures are likely to remain intense due to rising import prices and the growing number of competitive distribution channels such as the internet, DIY multiples and multiple retailers. Consumers will also become increasingly confident in negotiating discounts.

Forecasts indicate that the UK shower equipment market will stabilise in 2013 and return to modest growth from 2014, as consumer confidence and housebuilding levels gradually improve. By 2017, the overall market value is forecast to be £490 million at MSP, which would represent an increase of around 15% compared to the estimated market size in 2013, yet still be below the peak in 2008.

AMA Research's report: 'Shower Market Report - UK 2013-2017 Analysis' is available in hard copy or electronic format.

T: 01242 235724

E: [email protected]

W: www.amaresearch.co.uk

5th July 2013